SoulCycle Musicians Earn Tiny Royalties Despite Company's Heavy Reliance on Music

SoulCycle's music-driven business model relies heavily on carefully curated playlists and high-energy performances, yet pays surprisingly low royalty rates to musicians and rights holders. As the company files for IPO and expands rapidly, this disparity becomes increasingly significant.

Music's Critical Role at SoulCycle:

- Core component of their "cardio party" experience

- Essential to instructor-led classes

- Described as "the most important part" of their service

- Integral to their business model and marketing

Financial Context:

- 2014 revenue: $112 million from 36 locations

- 2015 projected revenue: $140 million

- Expected expansion to 250 locations

- Potential future annual revenue: $775 million

- Profit margins: 23% (2014)

Concert crowd with raised hands

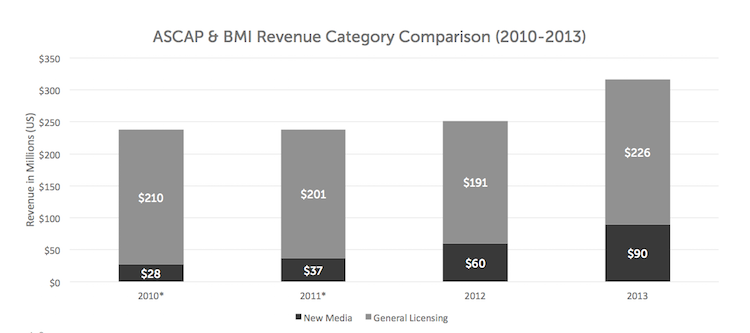

Current Licensing Structure:

- Licensed through ASCAP and BMI under "general licensing"

- Maximum BMI fee: $2,123 per year per location

- Represents only 0.01% of single location revenue

- ASCAP uses flat-fee structure per location

- Rates increase with inflation but don't consider premium pricing

Bar graph of music revenue comparison

Distribution Issues:

- Revenue distributed using inaccurate proxies

- Relies heavily on radio and TV performance samples

- Favors "Top 40" hits over niche genres

- Doesn't reflect actual song usage in classes

- Technology exists for better tracking but isn't utilized

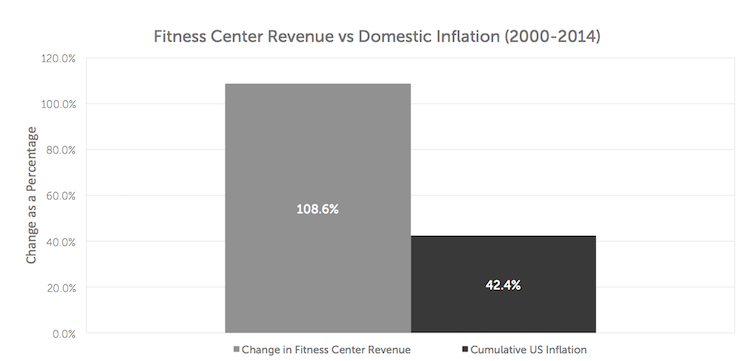

Growth Comparison:

- Fitness center revenue: 104% increase (2000-2014)

- US inflation: 48% increase (same period)

- SoulCycle growth: 108% (2012-2013), 49% (2013-2014)

Line graph: Spotify artist earnings trend

Recommendations for Improvement:

- Update licensing fee structures to reflect actual music usage

- Implement modern tracking technology

- Adjust distribution methods to accurately reflect played content

- Consider revenue-based licensing fees

- Modernize PRO operations for current market realities

While SoulCycle operates within existing licensing frameworks, the current system significantly undervalues music's contribution to their business model. PROs need to adapt their licensing and distribution methods to ensure fair compensation for rights holders in this growing market segment.

Related Articles

How to Submit Music Demos to Record Labels: A Step-by-Step Guide