Last Chance: How to Claim Your Missing $1,400 IRS Stimulus Check Before 2025 Deadline

The IRS is still distributing $1,400 stimulus checks to eligible taxpayers who missed the final round of Covid-19 relief payments. You must claim your payment before April 15, 2025, or forfeit the funds permanently.

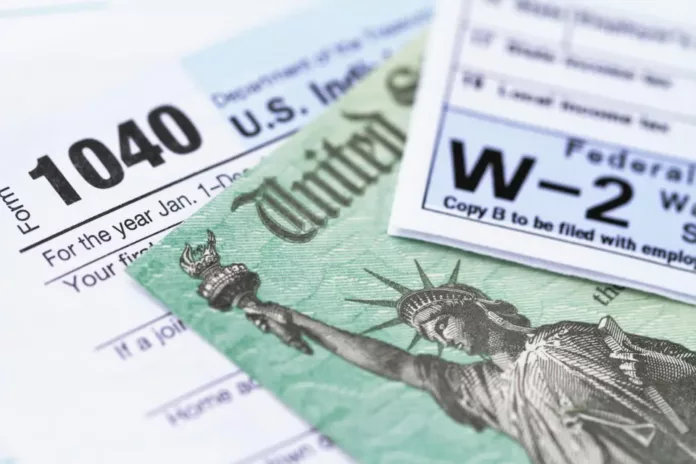

IRS tax refund status web page

Eligibility Requirements:

- Single filers: Income up to $75,000 (phases out at $80,000)

- Married filing jointly: Income up to $150,000 (phases out at $160,000)

- Each qualifying dependent adds $1,400, subject to income limits

- Must file 2021 tax return to claim payment

How to Claim Your Payment:

- File a 2021 tax return by April 15, 2025

- Claim the Recovery Rebate Credit on your return

- Provide direct deposit information for faster payment

- Submit even if you weren't required to file taxes in 2021

Important Notes:

- The IRS automatically corrects and issues payments for previously filed returns with incorrect Recovery Rebate Credit information

- You must file a 2021 return to receive payment if you haven't already

- The three-year claim window closes permanently on April 15, 2025

- Once the deadline passes, eligible recipients can't claim the payment

Those who never received their stimulus payment should verify eligibility and file a 2021 tax return immediately. This ensures you receive your entitled funds before the final deadline.

Related Articles

Unprecedented Social Security Crisis: How Musk's DOGE Department Sparked System-Wide Disruption