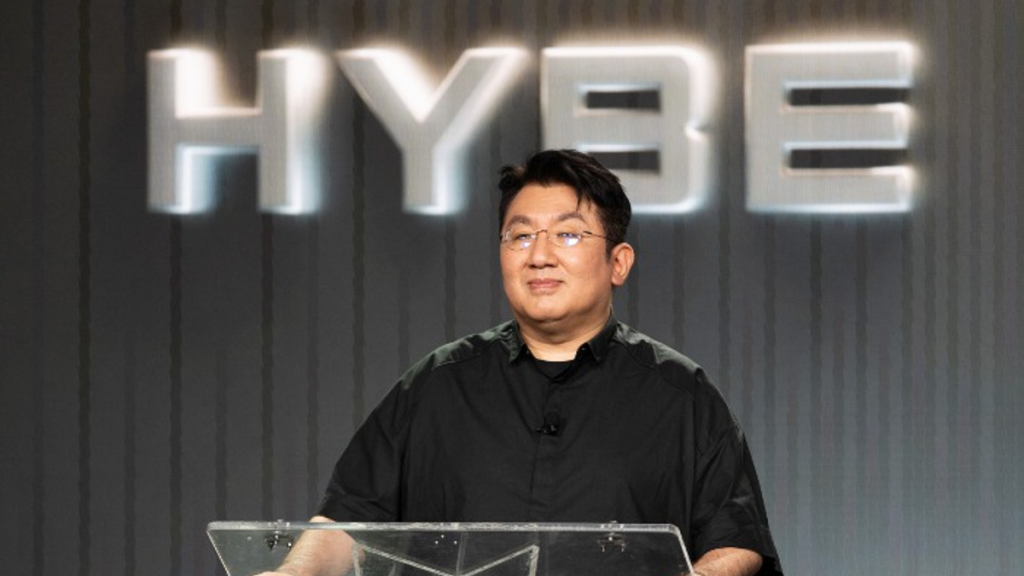

Hybe Chairman Bang Si-hyuk Under Investigation for 400 Billion Won IPO Deals with PE Firms

Bang Si-hyuk, chairman of Hybe, is under investigation regarding 400 billion won earned through undisclosed IPO agreements with private equity firms in 2020.

Bang Si-hyuk speaking at podium

The agreements involved three private equity funds:

- STIC Investments (3.46 million shares acquired in 2018)

- Eastone Equity Partners

- Neumain Equity

Key details of the agreements:

- Included a 30% profit-sharing clause upon successful IPO

- Was not disclosed during the listing process

- Legal teams deemed it a private agreement not requiring disclosure

Market impact:

- First trading day: 11.17 million shares traded

- STIC's sales: Only 1.7% of total volume

- Stock price: 150% surge from 135,000 won offering price

- Week later: 60% price drop

Background context:

- Agreements made in 2018 anticipated BTS's military service

- PEFs requested put option as risk protection

- Bang used personal shares to protect company interests

- Multiple law firms confirmed no legal violations

Current situation:

- Regulatory bodies investigating implications

- Calls for increased transparency in high-profile IPOs

- Additional pressure from NewJeans potentially leaving Hybe's Ador

- Continued scrutiny of Bang's role and decisions

Elton John wearing tinted medical glasses

Coachella crowd at night

Related Articles

Seoul Court Grants Ador's Injunction Against NewJeans — Group to Perform at ComplexCon Despite Legal Battle