Former Warner Music CEO Edgar Bronfman Jr. Teams With Bain Capital for $2 Billion Paramount Bid

Former Warner Music CEO Edgar Bronfman Jr., alongside private investment firm Bain Capital, has submitted a $2 billion offer for Paramount Global. This bid targets the controlling interest currently held by National Amusements Inc. (NAI), which owns 77% of Paramount's voting shares.

Paramount Global, owner of CBS, major movie studios, and networks including Comedy Central, Nickelodeon, and MTV, has attracted multiple potential buyers. Hollywood producer Steven Paul is reportedly preparing a competing $3 billion offer for the controlling stake.

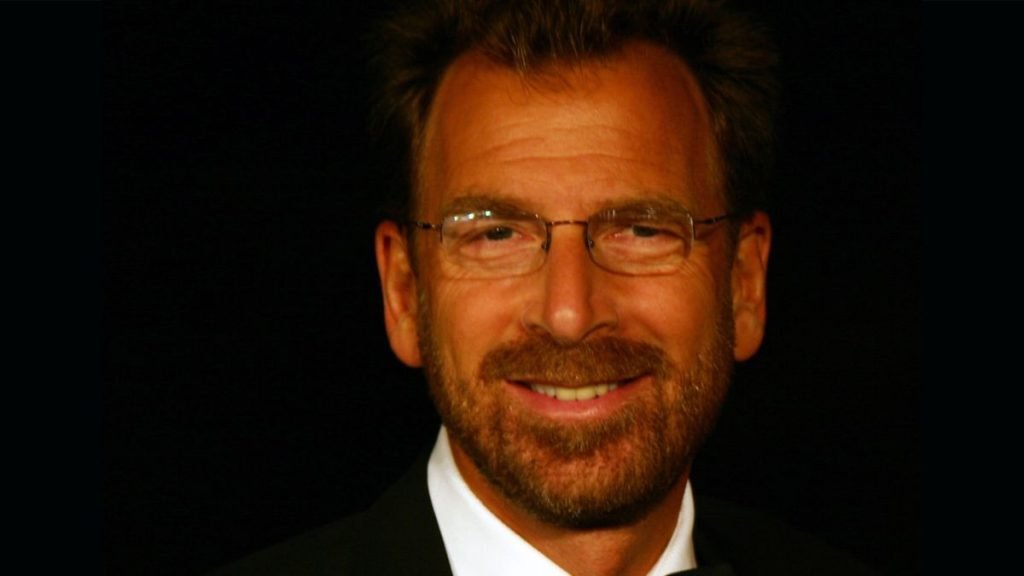

Edgar Bronfman Jr. smiles at camera

Current owner Shari Redstone is in discussions with Skydance Media and financial partners RedBird Capital and KKR regarding a potential merger. The proposed deal would see Skydance acquire NAI for $2 billion, with Class B shareholders receiving $15 per share. This arrangement would give Skydance two-thirds ownership while maintaining Paramount's public status.

The interest in Paramount has intensified following S&P Global's March 2024 decision to downgrade the company's debt rating to junk status. Paramount Global carries $14.6 billion in long-term debt as of late 2023, with S&P Global emphasizing the need for improved streaming performance to avoid further rating downgrades.

Bronfman brings significant media industry experience, having served as Warner Music Group's chairman and CEO from 2004 to 2012. He currently serves as executive chairman of Fubo, a sports-focused streaming service, and previously led Seagram before its sale to Vivendi in 2000.

Taylor Swift performing on concert stage

Apple logo against gray backdrop