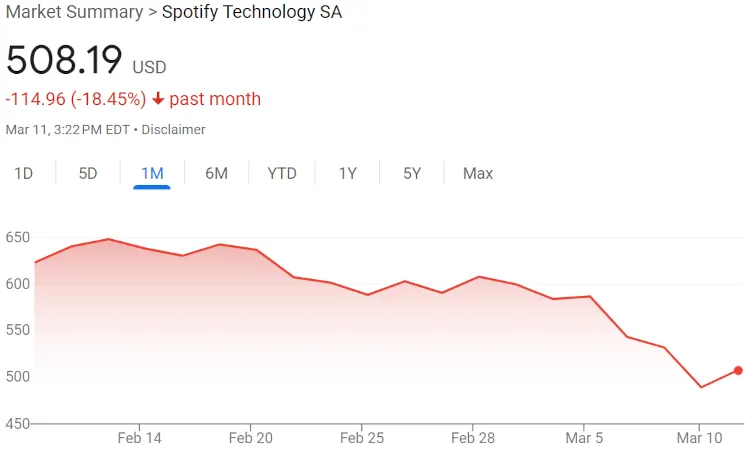

Spotify Stock Drops 20% from Peak Despite Strong Year-to-Date Performance

Spotify stock (NYSE: SPOT) has experienced a significant decline of almost 19% since mid-February 2025, amid broader market corrections. Despite this drop, the stock maintains a price above $500 per share.

Spotify stock price chart March 2025

Current Performance Overview:

- Trading at $508 (4% daily increase)

- Down 18.5% from February 11th peak

- Below 52-week high of $653

- Up 11% since start of 2025

- Nearly 100% increase from March 2024

The recent decline follows a period of rapid growth driven by the company's increased focus on profitability and premium offerings. Despite the correction, analysts remain optimistic, with JPMorgan setting a target price of $730, while Redburn Atlantic projects $545.

Recent Insider Trading Activity:

- Eve Konstan (Former General Counsel): Sold 777 shares for $481,740 (March 3)

- Daniel Ek (CEO): Sold 50,000 shares for $29.21 million (March 5)

- Katarina Berg (HR Head): Sold 2,166 shares for $1.08 million (Recent)

Market observers suggest this correction might continue as investors focus on sustainable profitability metrics. Spotify's shift away from aggressive acquisitions toward sustainable growth and consistent subscriber gains appears to be key for maintaining investor confidence.

Businessman checking phone with charts

George Clinton files copyright lawsuit

Related Articles

Boeing Stock Surges 5% After Securing $20B Defense Contract Despite Industry Headwinds